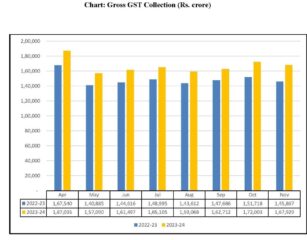

GST collection during the month of November 2023

Reading Time: < 1 minute GST collection during the month of November 2023 crossed 1.67 lakh crore The gross GST revenue collection for the month of November, 2023 is ₹1,67,929 crore out of which CGST is ₹30,420 crore, SGST is ₹38,226 crore, IGST is ₹87,009 crore (including ₹39,198 crore collected on import of goods) and cess is ₹12,274 crore (including

Read More